Workers' compensation insurance for real estate businesses

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers' compensation protects employees at your real estate office

Whether at the office or on-site at a property, your employees are susceptible to work-related injuries. The cause could be as simple as moving heavy furniture or tripping on an uneven step. Even a minor injury can result in medical bills and time taken off work.

Workers’ compensation insurance provides coverage in three primary areas:

- Employee medical expenses

- Employee injury lawsuits

- Compliance with state laws

What coverage can workers' comp insurance provide for real estate agents?

Employee medical expenses

When an employee is injured, your real estate business could be held liable. Workers’ compensation insurance helps cover:

- Medical bills, such as emergency room costs

- Ongoing care, including physical rehabilitation

- Missed wages during recovery

- Death benefits for fatal incidents

Employee injury lawsuits

If one of your employees claims that an unsafe work environment or your negligence led to an injury, you could face a lawsuit. Employer’s liability insurance, typically included in workers’ compensation, can help cover expenses related to lawsuits. That includes:

- Attorney’s fees

- Court-mandated judgments

- Settlements

- Witness fees

How much does workers' comp cost for real estate businesses?

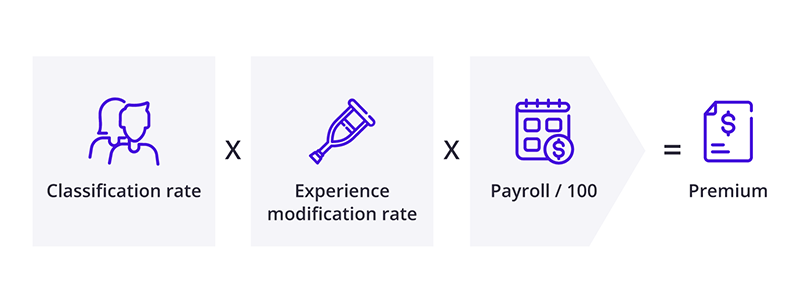

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers' compensation requirements for real estate businesses

In most states, real estate businesses must provide workers’ compensation insurance as soon as they hire their first employee. Without this policy, you could face fines or even jail time.

Each state has its own laws for workers’ compensation requirements. For example, every real estate business in New York must carry workers’ compensation for its employees – even part-time workers. However, Alabama businesses are only required to carry workers’ compensation when they have five or more employees.

Sole proprietors, independent contractors, and partners don’t have to carry workers’ compensation insurance, but you can purchase a policy to protect yourself, too. It's a good idea to carry this coverage, as health insurance providers can deny claims for injuries that are related to your job.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, real estate businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Lower workers' comp costs with risk management

Even office workers are at risk for an injury. They could slip on a wet floor or trip over a power cord. If an employee is injured on the job, it could lead to an insurance claim and a rise in your premiums.

Business owners can mitigate risks by providing safety training and eliminating hazards such as loose rugs, clutter, and dim lighting. Taking these steps could reduce workplace injuries and help keep your insurance rates low.

Top real estate professionals we insure

Don't see your profession? Don't worry. We insure most businesses.

Other important policies for real estate professionals

While workers’ compensation insurance protects your employees and to some extent your business, it does not provide complete protection. Accidents can happen in any real estate profession. Other policies to consider include:

General liability insurance: A general liability policy covers common business risks like customer injury, damage to a customer’s property, and advertising injury.

Commercial umbrella insurance: Provides additional coverage for liability claims made on general liability, commercial auto, or employer’s liability insurance, once a policy's limit is reached.

Business owner's policy (BOP): This policy combines general liability insurance with commercial property insurance, typically at a lower rate than if the policies were purchased separately.

Commercial auto insurance: This policy covers business-owned vehicles. It typically pays for accidents and damages related to theft, weather, and vandalism.

Cyber liability insurance: This policy helps real estate businesses survive cyberattacks and data breaches by paying for recovery expenses and other associated costs.

Errors and omissions insurance (E&O): Also called professional liability insurance, this policy can cover legal fees of lawsuits related to a real estate professional's business decisions.

Lessor's risk only insurance: This policy protects commercial landlords from tenant lawsuits over property damage and injuries.

Get free quotes and buy online with Insureon

Are you ready to safeguard your real estate business with workers' compensation insurance? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage in less than 24 hours.