How much does insurance cost for real estate businesses?

Several factors affect the cost of business insurance for real estate agents and brokers, including your business's size and revenue. Cost estimates are sourced from policies purchased by Insureon customers.

General liability insurance costs for real estate professionals

Real estate businesses pay a median premium of about $30 per month, or $390 per year, for general liability insurance. This policy provides financial protection for third-party bodily injuries, third-party property damage, and advertising injuries.

Insureon’s licensed agents recommend a business owner’s policy over a standalone general liability policy. A BOP combines general liability insurance with commercial property insurance to protect your real estate agency, and costs less than purchasing each policy separately.

Your level of risks affects general liability costs

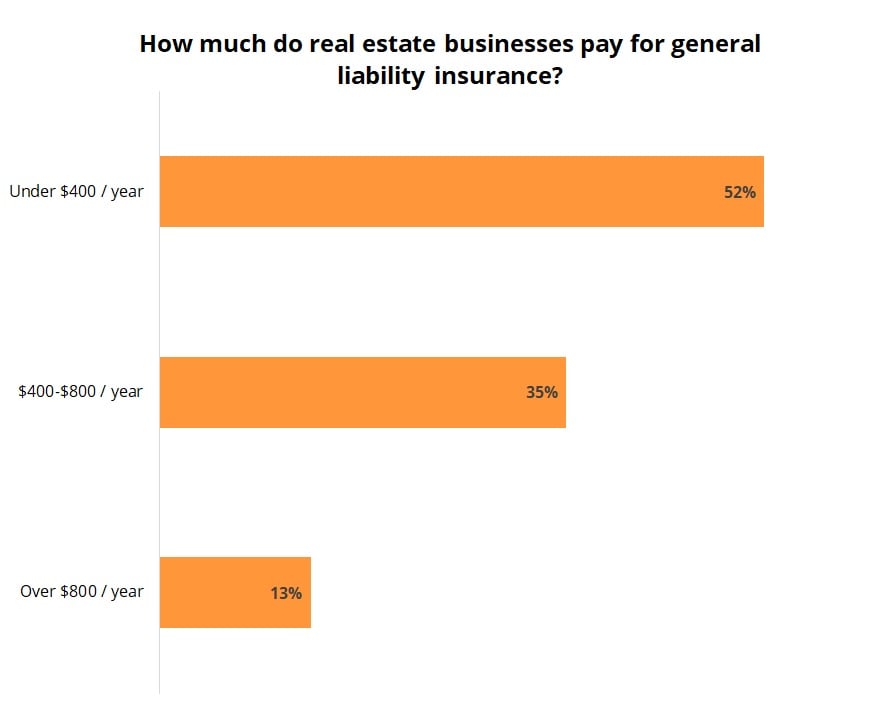

Among real estate businesses that purchase general liability insurance with Insureon, 52% pay less than $400 per year and 35% pay between $400 and $800 per year. Factors such as the size of your business and its risks affect the cost of general liability insurance.

Common general liability limits for real estate businesses

Policy limits determine how much your insurer will pay on covered claims. A per-occurrence limit is the maximum your insurer will pay for a single incident, while an aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year.

Most real estate businesses (89%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's general liability insurance cost analysis page.

Errors and omissions insurance costs for real estate professionals

The median cost of errors and omissions insurance (E&O) for real estate businesses is about $55 per month, or $665 annually.

This policy can protect your business from work mistakes that negatively impact clients. It's sometimes called professional liability insurance.

The cost of E&O insurance depends on your risks

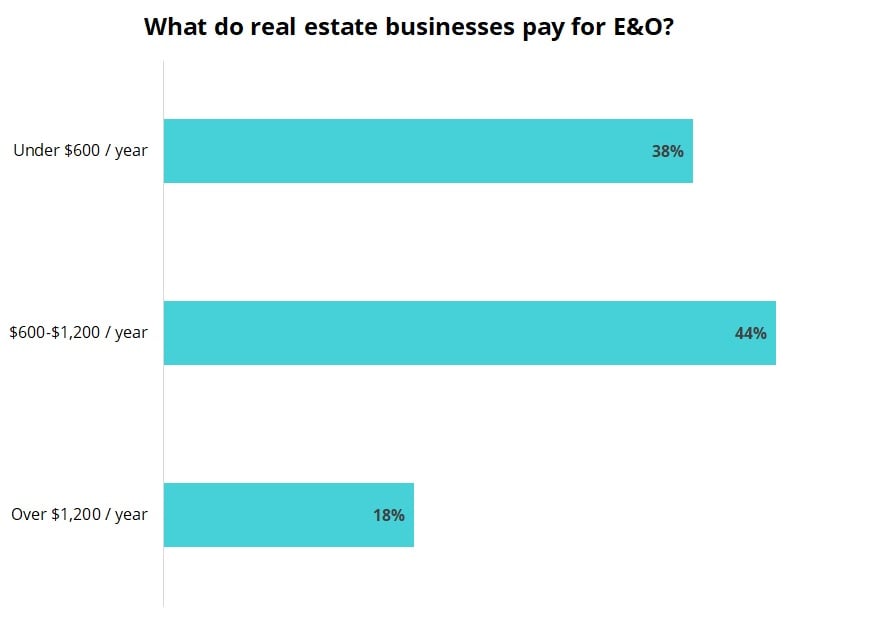

Among real estate businesses that purchase errors and omissions insurance with Insureon, 38% pay less than $600 per year and 44% pay between $600 and $1,200 per year. The cost depends on your type of real estate business and other key operations factors.

Which errors and omissions insurance limits do real estate companies choose?

Most real estate businesses (61%) choose errors and omissions policies with a $1 million per-occurrence limit and a $1 million aggregate limit. Another 26% choose policies with a $500,000 per-occurrence limit and a $500,000 aggregate limit.

Professional risks affect the cost of an E&O policy

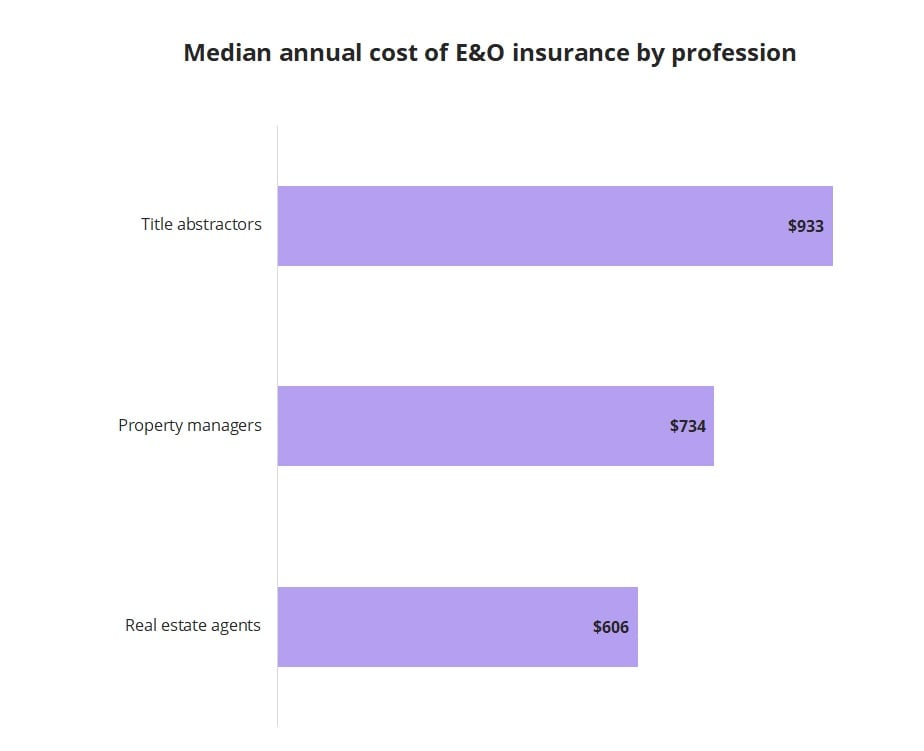

In professions where work mistakes can have serious financial repercussions for a client, such as a title abstractor overlooking a zoning restriction on a property, you may find yourself paying more for this policy. The cost varies significantly among real estate professionals.

For example, the annual median premium for a title abstractor is $933, while the median for a real estate agent is $606 – or about $50 a month.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's errors and omissions insurance cost analysis page.

Workers’ compensation insurance costs for real estate professionals

The median premium for workers’ compensation insurance is about $50 per month, or $620 per year for real estate businesses. This policy helps cover medical bills and partial lost wages when an employee suffers a work-related injury or illness.

Real estate businesses with employees typically must purchase this policy to meet state requirements and avoid penalties. Sole proprietors might also buy workers' comp for financial protection against work injuries, something their health insurance could exclude.

Workers’ comp costs depend on the number of employees

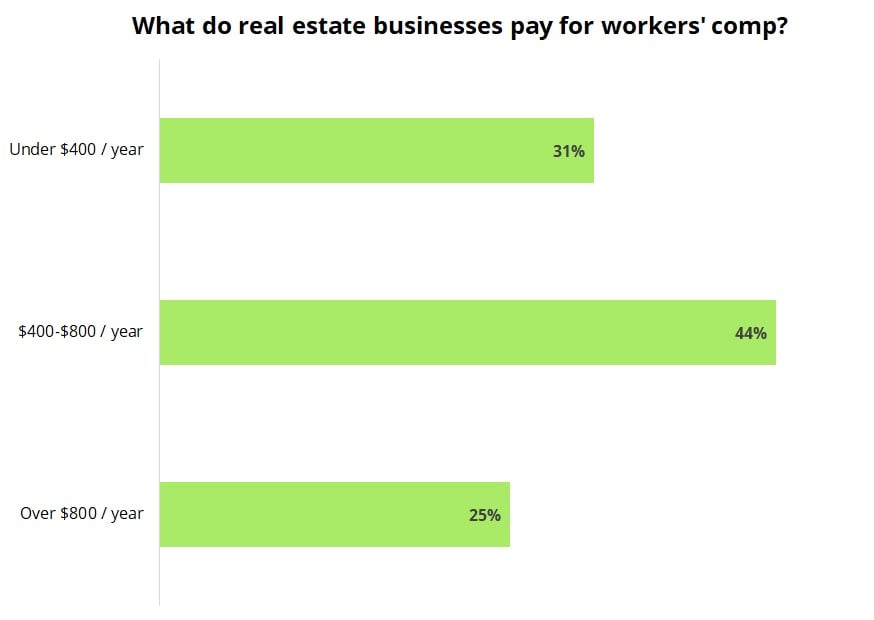

Among real estate businesses that purchase workers’ compensation insurance with Insureon, 31% pay less than $400 per year and 75% pay less than $800 per year. The cost depends on the number of employees and the level of risk involved with their jobs, among other factors.

Learn how workers' comp premiums are calculated and more on Insureon's workers' compensation insurance cost analysis page.

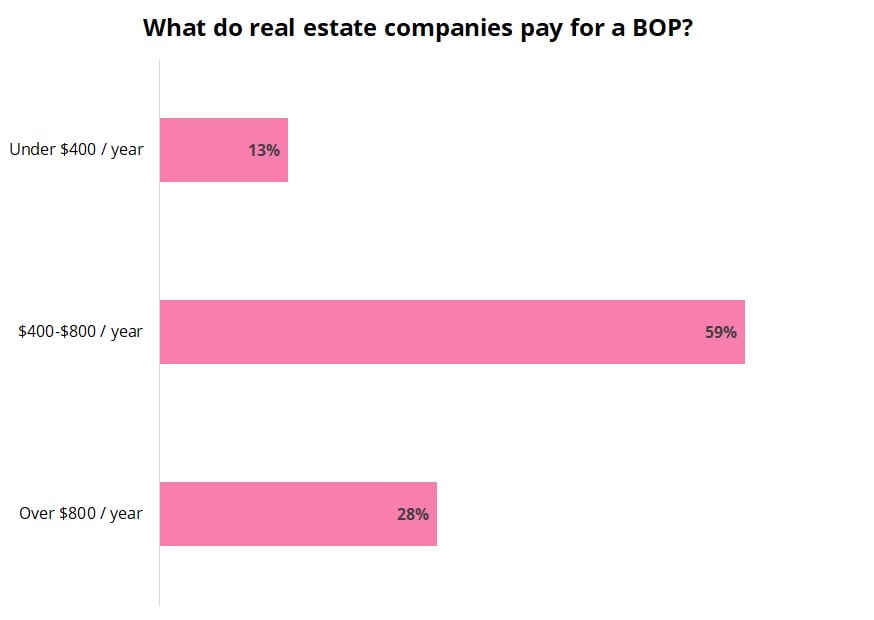

Business owner’s policy costs for real estate businesses

Real estate businesses pay a median premium of less than $45 per month, or $520 per year, for a business owner’s policy. This policy combines general liability insurance with commercial property insurance, typically at a lower rate than if the policies were purchased separately.

A BOP protects against third-party injuries and property damage, along with damage to your own business property. Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s licensed agents.

The cost of a BOP depends on your business property

Among real estate businesses that purchase a business owner’s policy with Insureon, 13% pay less than $400 per year and 59% pay between $400 and $800 per year. The cost depends primarily on the value of your business property.

Business owner’s policy limits for real estate businesses

Most real estate businesses (79%) choose a business owner’s policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's business owner's policy cost analysis page.

Commercial auto insurance costs for real estate professionals

Small businesses pay a median premium of $142 per month or $1,704 per year for commercial auto insurance. Most states require this coverage for business-owned vehicles.

Your premium depends on the value of your vehicles, along with factors like how often they are driven. You'll need to check your state laws to find out minimum requirements for this coverage in your area.

Learn how coverage limits and other factors affect the cost of this policy on Insureon's commercial auto insurance cost analysis page.

Cyber insurance costs for real estate professionals

Small businesses pay a median premium of $140 per month, or $1,675 per year, for cyber liability insurance. The cost of this policy depends on how much sensitive information your agency handles, and how many employees can access it.

Cyber liability insurance covers costs related to data breaches and cyberattacks. It provides crucial protection for any real estate professional who handles credit cards or conducts business online.

Learn how to save money on your policy, which coverage limits to choose, and more on Insureon's cyber liability insurance cost analysis page.

Compare quotes from trusted carriers with Insureon

Insureon’s real estate business insurance agents work with top-rated U.S. carriers to find affordable coverage that fits your business. Apply today to compare multiple quotes with one free online application. Work with an account manager specializing in the unique risks of real estate agents, commercial landlords, and property managers.